Mining in Transition: What Q4 2025 Is Telling Us About the Next Cycle

Elementra Capital – Research Division | October 2025

Market Context

The final quarter of 2025 is shaping up to be one of the most pivotal moments for the global mining sector in the last decade. After a period marked by volatility, cost inflation, and geopolitical bottlenecks, the industry is entering a new equilibrium — one defined not by growth at all costs, butby selectivity, operational discipline, and capital structure.

Global production across major base and precious metals is tightening.

Supply disruptions, delayed projects, and a decade of underinvestment are converging into a new price regime — one that is structural, not cyclical.

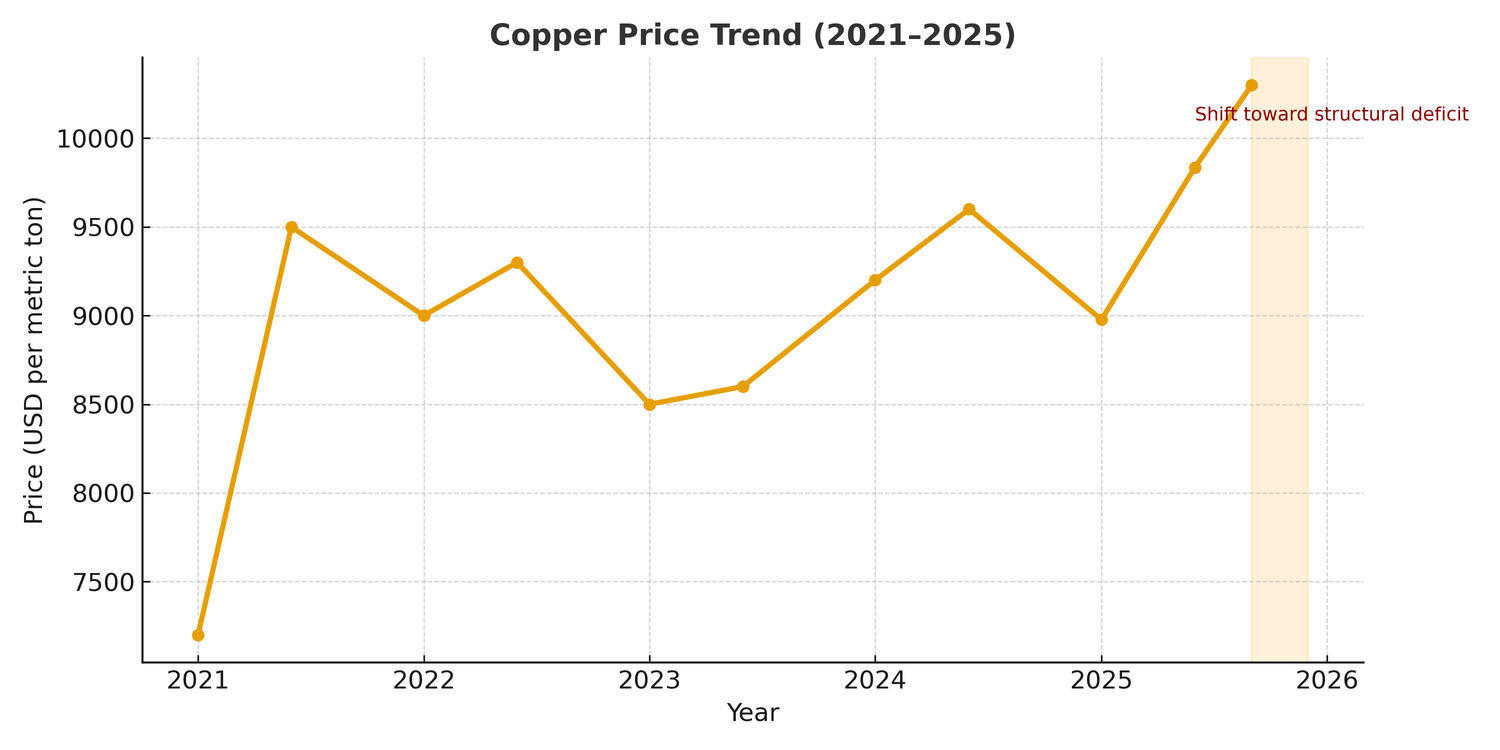

Copper: Supply Tightness Becomes Structural

Copper is signaling the clearest structural shift.

After years of consensus forecasts projecting a surplus, the market has

moved into a controlled deficit.

The operational halt at Freeport’s Grasberg mine in Indonesia — one of the world’s largest producers — has removed over 500,000 tonnes from the global balance sheet. At the same time, Codelco’s production downgrade from El Teniente and Chuquicamata underscores a systemic pattern: aging mines, declining ore grades, and capital fatigue.

Spot copper prices have consolidated above $10,400/t, reflecting a new normal rather than a speculative peak.

Institutional positioning is consistent with this narrative — refined inventories are at multi-year lows, and long-term contracts are being repriced around supply reliability, not volume.

Elementra View: The next copper cycle will not reward new exploration. It will reward operational certainty and execution in politically stable jurisdictions.

Source: IMF Primary Commodity Prices Database; LME Market Data (2021–2025)

Gold: The Rise of Structural Allocation

Gold’s rally through 2025 — up nearly 48% YTD, reaching levels above $3,850/oz — is not merely a reaction to macro volatility.

It represents a structural reallocation of institutional capital.

Central banks, led by China, Turkey, and India, have continued their record accumulation pace. Concurrently, sovereign wealth funds and pension managers have expanded gold exposure as part of a strategic hedge against fiscal instability, real rate compression, and de-dollarization trends.

Unlike previous cycles, ETF inflows are not fleeting; they are sustained.

Gold’s new role is as a permanent portfolio pillar, not a crisis hedge.

Elementra View: Gold is no longer the asset investors turn to in uncertainty — it’s the asset they hold to remain certain.

Battery Metals: Divergence Defines the Landscape

While copper and gold redefine structural value, the battery metals complex is undergoing a bifurcation.

Lithium remains under price pressure — down nearly 70% from 2022 highs — but market indicators suggest a bottoming phase. Supply expansion, mainly from Australia and China, is finally normalizing, while demand growth from EV production is stabilizing at sustainable double digits.

Conversely, nickel remains trapped in Indonesia’s production cycle.

Overcapacity in smelters has kept prices capped around $15,000–$16,000/t, despite increased demand from the energy transition.

This divergence reflects the market’s maturation: oversupply in low-barrier metals, scarcity premium in technically constrained ones.

Elementra View: The new alpha in battery metals lies not in price speculation, but in supply chain integration and jurisdictional diversification.

The Exploration Gap

Global exploration budgets for 2025 have fallen to a 10-year low.

The consequences of that underinvestment are beginning to materialize.

Few large-scale discoveries have been made in the last five years, and permitting timelines continue to extend.

The scarcity of new, fully permitted, and technically viable assets is pushing mid-tier developers into strategic relevance.

In practical terms, “optionality” is becoming an asset class of its own.

Elementra View: The market is quietly repricing time-to-production as a premium variable. Patience is the new leverage.

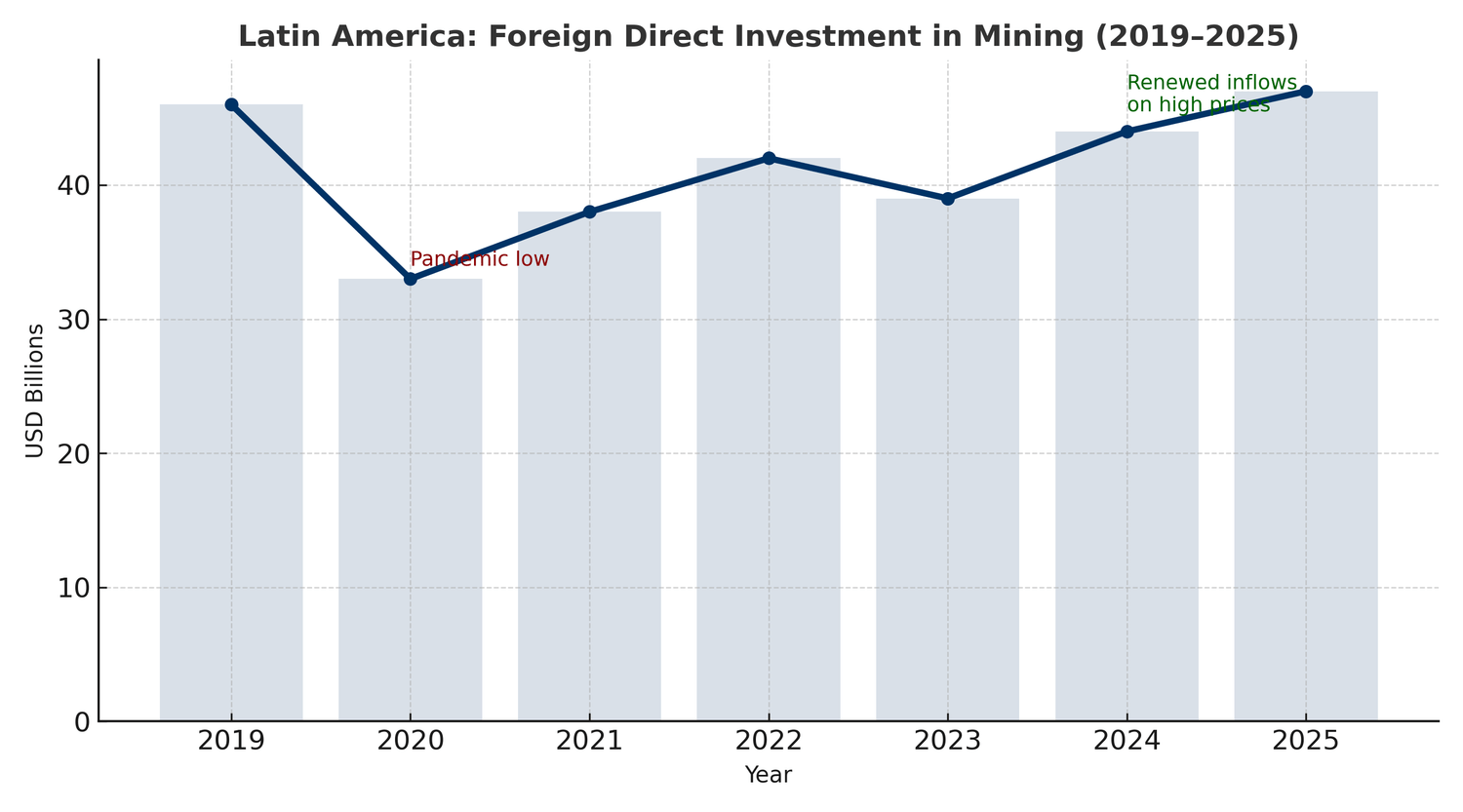

Latin America: The Jurisdiction Premium

Nowhere is this transition more visible than in the Andean corridor.

Chile remains the region’s benchmark, but its copper output has stagnated at 5.4–5.5 Mtpa amid delays in major expansion projects.

Peru, while rich in untapped resources, continues to face regulatory and social headwinds — including new proposals on concession caducity and ongoing local protests impacting logistics.

Despite the noise, institutional interest in high-grade Peruvian projects remains strong, supported by solid fundamentals and improving transport infrastructure.

Elementra View: The Andean region will continue to attract capital — but it will favor local intelligence over scale. In mining, context is now part of due diligence.

Source: UNCTAD World Investment Report 2025; ECLAC Foreign Direct Investment in Latin America and the Caribbean 2025;

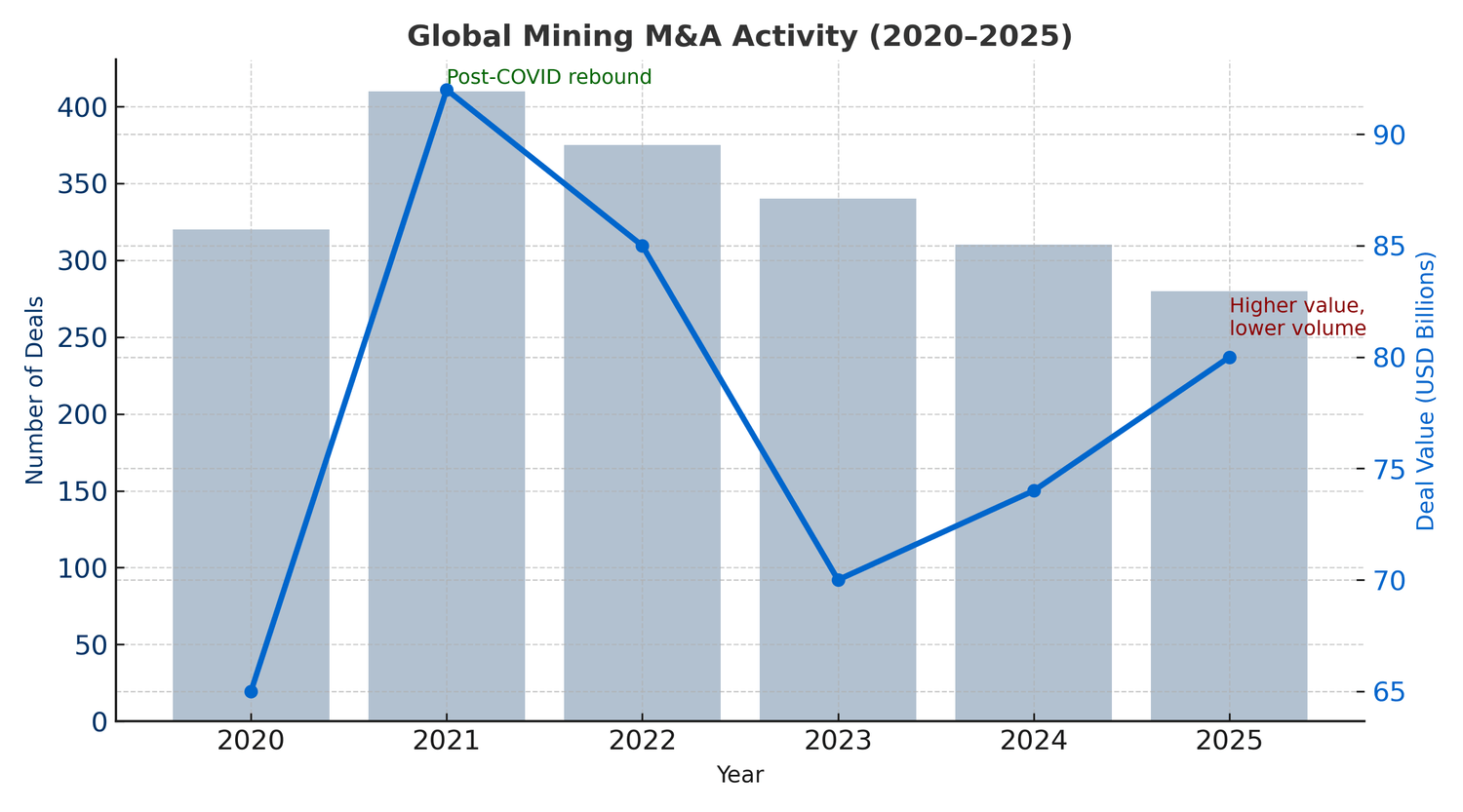

Capital & M&A Outlook

Global mining M&A in 2025 declined 9% by volume but increased 15% by value.

Dealmakers are focusing on de-risked brownfield projects, strategic JVs, and infrastructure-linked assets rather than speculative exploration.

With monetary policy easing and commodity prices firming, 2026 could mark the return of selective capital deployment — particularly in copper, gold, and rare earths.

Elementra View: The next wave of mining investment will look less like a boom — and more like a reallocation of intelligence.

Source: PwC Mining Deals Outlook 2025; EY Global Mining & Metals M&A Trends 2025; Elementra Capital Research.

Conclusion

The data from Q4 2025 makes one thing clear: the age of easy money and speculative expansion in mining is ending.

The next cycle will not reward size — it will reward structure. Capital will migrate toward disciplined operators, audited data, and projects built on transparency, governance, and real geological fundamentals.

At Elementra Capital, we don’t see this as a slowdown, but as a reset — a transition from noise to signal, where only precision and integrity will compound value.

Elementra Capital Research – October 2025

For professional investors and institutional partners.

Disclaimer:

This website is for informational purposes only and does not constitute an offer, solicitation, recommendation, or commitment for any transaction, nor to buy or sell any security or financial product. Nothing herein should be interpreted as investment advice or as a confirmation of any transaction.

Products and services described on this website may not be available to residents of certain jurisdictions. Please consult with a registered representative regarding the specific product or service in question for further information.

All investments involve risk and are not guaranteed to appreciate. Any market price, indicative value, estimate, opinion, data, or other information provided herein is not warranted for completeness or accuracy, is subject to change without notice, and Elementra Capital accepts no liability for its use, nor any obligation to update or keep it current.

Copyright © 2025 Elementra Capital | Terms and Conditions